How to Read PnL Analysis?

Understanding your Profit and Loss (PnL) analysis is crucial for assessing your trading performance.

What is PnL?

PnL, or Profit and Loss, is a metric used to track the amount of money you’ve gained or lost from your cryptocurrency trading. It offers a clear view of your trading performance by breaking it down into three key components:

- Realized PnL: Profit or loss from completed trades. For example, if you bought Bitcoin at $85,000 and sold it at $90,000, your realized profit would be $5,000, minus any fees.

- Unrealized PnL: Potential profit or loss from assets you’re still holding. For instance, if you purchased Ethereum at $3,000 and its current value is $3,500, your unrealized PnL is $500.

- Total PnL: The sum of Realized and Unrealized PnL, reflecting your overall trading performance.

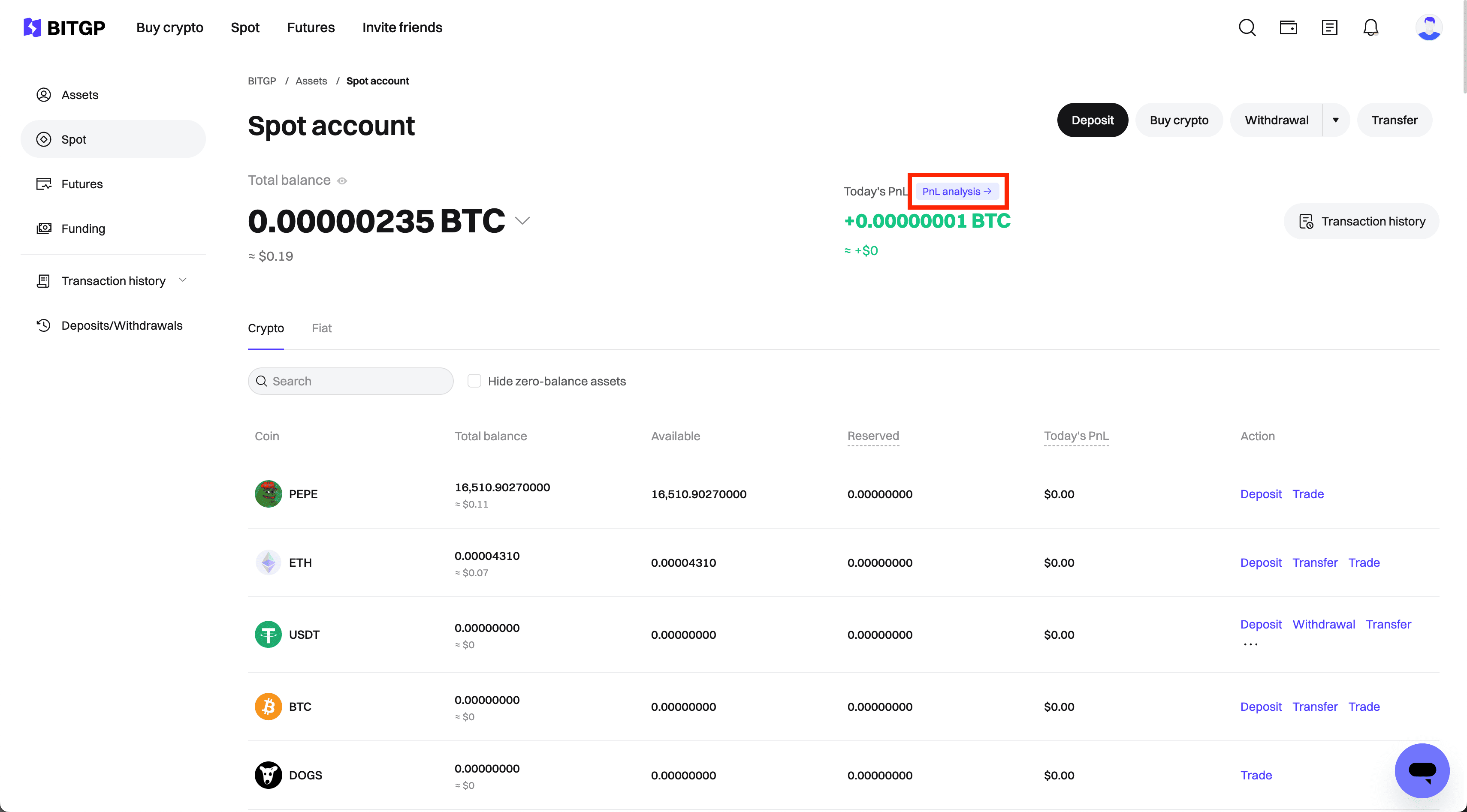

How to Access PnL Analysis on the BITGP Website

- Go to Assets and select Spot Account from the options

- Click on PnL Analysis.

- Once selected, you’ll see the following tabs:

- Account Analysis

- Coin Analysis

- Trading Analysis

How to Access PnL Analysis on the BITGP Mobile App

- Tap Assets on the bottom navigation bar.

- Tap Today’s PnL to access the Spot PnL analysis page.

Account Analysis

The Account Analysis tab provides an overview of your total PnL and asset value:

- Estimated Asset Value: Shows the total value of your assets in BTC and its USD equivalent.

- Today’s PnL: Displays your profit or loss in USD for the current day.

- 7-Day PnL and 30-Day PnL: Summarizes your cumulative PnL over the past 7 and 30 days, aiding in short-term performance evaluation.

- Custom Date Range: Allows you to select specific dates to calculate your total PnL for any period.

Coin Analysis

The Coin Analysis tab provides insights into the performance of individual cryptocurrencies in your portfolio:

- Total: Displays the total holdings and current value of the selected cryptocurrency.

- Transaction Holdings (BTC): Indicates the total number of coins you currently hold.

- Breakeven Price (USDT): Reflects the average price at which you can sell your asset without a loss, accounting for changes in position size and trading fees. This updates with new trades or adjustments, helping you pinpoint the price needed to recover your investment.

- Cost Price (USDT): Represents the average cost of your asset, including the initial purchase and any additional buys. It reflects the price of incremental additions, offering a clear view of your total investment cost over time.

- Last Price (USDT): Shows the current market price of the selected cryptocurrency.

- Total PnL and ROI: Highlights your overall profit or loss and return on investment for the specific coin.

Trading Analysis

The Trading Analysis tab offers a detailed breakdown of your trading performance for specific trading pairs:

- Base and Quote: Lets you select a trading pair (e.g., BTC/USDT) for analysis.

- Realized PnL: Shows the profit or loss from completed trades for the chosen pair.

- Unrealized PnL: Displays potential profit or loss from open positions, compared to their purchase price.

- Transaction Fees: Lists the fees paid, with an option to enable BGB fee deduction for discounts.

FAQs

- Can I customize the PnL analysis for specific trading pairs?

Yes, you can choose specific trading pairs in the Trading Analysis tab using the Base and Quote dropdown menus. - How do I calculate ROI for a specific coin?

ROI is automatically calculated as a percentage of your total investment in the Coin Analysis tab. - Why is my Unrealized PnL showing 0?

Unrealized PnL only displays values if you have open positions in the selected trading pair. If there are no active trades, it will show 0. - How are transaction fees calculated in PnL analysis?

Fees are deducted based on your trading volume and fee tier. A detailed breakdown is available under the Transaction Fees section in the Trading Analysis tab. - How often should I check my PnL analysis?

Review your PnL daily, after significant trades, or during major market movements to stay informed about your performance.

Disclaimer and Risk Warning

All trading tutorials provided by BITGP are for educational purposes only and do not constitute financial advice. The strategies and examples shared are illustrative and may not reflect actual market conditions. Cryptocurrency trading involves significant risks, including the potential loss of your funds. Past performance does not guarantee future results. Always conduct thorough research and understand the risks involved. BITGP is not responsible for any trading decisions made by users.